For instance, the first option leads to the earnings money going out of the books and accounts of the business forever because dividend payments are irreversible. In financial modeling, it’s necessary to have a separate schedule for modeling retained earnings. The schedule uses a corkscrew-type calculation, where the current period opening balance is equal to the prior period closing balance. In between the opening and closing balances, the current period net income/loss is added and any dividends are deducted. This helps complete the process of linking the 3 financial statements in Excel. Cash dividends reduce shareholders’ equity on the balance sheet, reducing retained earnings and cash.

Movements in a company’s equity balances are shown in a company’s statement of changes in equity, which is a supplementary statement that publicly traded companies are required to show. Both the beginning and ending retained earnings would be visible on the company’s balance sheet. The most obvious reason for negative retained earnings is a lack of profitability.

Retained Earnings Explained

Revenue, net profit, and retained earnings are terms frequently used on a company’s balance sheet, but it’s important to understand their differences. negative retained earnings appear as a debit balance in the retained earnings account, rather than the credit balance that normally appears for a profitable company. On the company’s balance sheet, negative retained earnings are usually described in a separate line item as an Accumulated Deficit.

- Profits give a lot of room to the business owner(s) or the company management to use the surplus money earned.

- Retained earnings are directly impacted by the same items that impact net income.

- Both cash dividends and stock dividends result in a decrease in retained earnings.

- These are the long term investors who seek periodic payments in the form of dividends as a return on the money invested by them in your company.

- They are a measure of a company’s financial health and they can promote stability and growth.

- No, Retained Earnings represent the cumulative profit a company has saved over time.

If a company decides not to pay dividends, and instead keeps all of its profits for internal use, then the retained earnings balance increases by the full amount of net income, also called net profit. When a company pays dividends to its shareholders, it reduces its retained earnings by the amount of dividends paid. As a result, additional paid-in capital is the amount of equity available to fund growth. And since expansion typically leads to higher profits and higher net income in the long-term, additional paid-in capital can have a positive impact on retained earnings, albeit an indirect impact. Revenue, sometimes referred to as gross sales, affects retained earnings since any increases in revenue through sales and investments boost profits or net income. As a result of higher net income, more money is allocated to retained earnings after any money spent on debt reduction, business investment, or dividends.

Amortization of Intangible Assets

Thus, any item that leads to an increase or decrease in the net income would impact the retained earnings balance. The beginning period retained earnings appear on the previous year’s balance sheet under the shareholder’s equity section. The beginning period retained earnings are thus the retained earnings of the previous year. Since stock dividends are dividends given in the form of shares in place of cash, these lead to an increased number of shares outstanding for the company. That is, each shareholder now holds an additional number of shares of the company.

Now, you must remember that stock dividends do not result in the outflow of cash. In fact, what the company gives to its shareholders is an increased number of shares. Accordingly, each shareholder has additional shares after the stock dividends are declared, but his stake remains the same.

Create a free account to unlock this Template

If a company is not generating enough profits to cover its expenses, it will eventually accumulate losses and end up with negative retained earnings. This can be caused by a variety of factors, such as increased competition, changing market conditions, or inefficient operations. When a company has negative retained earnings, it means that the company’s losses are more significant than its accumulated profits. This can concern investors and creditors, as it may indicate that the company is in financial distress. Retained Earnings are a vital financial metric that sheds light on a company’s financial strength and growth potential.

- However, it can be challenged by the shareholders through a majority vote because they are the real owners of the company.

- Understanding the industry’s norms and dynamics is crucial when interpreting retained earnings.

- Despite this, not using its earnings balance may not be a good thing as this money loses value over time.

- As mentioned earlier, management knows that shareholders prefer receiving dividends.

- The figure from the end of one accounting period is transferred to the start of the next, with the current period’s net income or loss added or subtracted.

When the management is looking to invest in the near future, they usually don’t pay dividends. Instead, they invest this amount in expanding and growing the company, which slowly increases its overall value. In other words, negative shareholders’ equity should tell an investor to dig deeper and explore the reasons for the negative balance. If the retained earnings balance is gradually accumulating in size, this demonstrates a track record of profitability (and a more optimistic outlook).

Example of a retained earnings calculation

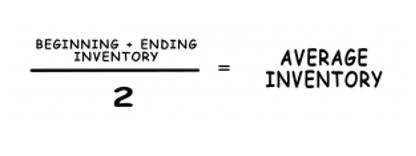

Retained earnings refer to the money left over from a company’s profit after it pays direct and indirect costs, such as dividends and income taxes. So if a company earned $10,000 last year and $10,000 this year (after accounting for costs), its retained earnings are $20,000. Negative retained earnings are a sign of poor financial health as it means that a company has experienced losses in the previous year, specifically, a net income loss. The retained earnings are calculated by adding net income to (or subtracting net losses from) the previous term’s retained earnings and then subtracting any net dividend(s) paid to the shareholders. Profits give a lot of room to the business owner(s) or the company management to use the surplus money earned. This profit is often paid out to shareholders, but it can also be reinvested back into the company for growth purposes.